The History of Retro Culture: From Scarcity to Surplus

How the sneaker industry sold us the same shoes... until we stopped buying them

The retro sneaker game wasn’t always like this. There was a time when bringing back an old shoe was actually... special.

I remember when the Air Jordan 1 Retro first came back in 1994. Not a remaster, not a reimagining... just the OG colorways returning after nine years. People lost their minds. Why? Because it had been nine years. An entire generation of kids who were too young to get the originals finally had their shot.

More importantly, Nike wasn’t flooding the market. They brought back select colorways, limited quantities, and then moved on. The 1994 retros sold out, created buzz, and then... that was it. You either got them or you didn’t. No restocks every six months. No “we heard you liked this so here’s another release next quarter.”

The business model was simple... use nostalgia as a special occasion, not a crutch.

Fast forward to 1997. Jordan Brand becomes its own entity within Nike. Within a few years, the retro cycle really gets codified. They establish a pattern... retro the numbered Jordans, give each model its moment, create anticipation.

And it worked beautifully. For a while.

The Air Jordan 11 became an annual Thanksgiving/Christmas tradition starting in 2000 with the Space Jams. Once a year. Same model. Same hype. People camped out. Stores got robbed. It was chaos... but it was controlled chaos. The scarcity was real, not manufactured.

In my role managing special projects at Sole Collector, I saw this shift firsthand while building the Eastbay blog years later. Eastbay was one of the first major retailers really leaning into the digital storytelling around retros. We would publish heritage content about the original releases, sometimes interview people who worked on the shoes, contextualize why they mattered.

The engagement was insane. People that knew, were stoked. People that didn’t, wanted to understand why a shoe was important, not just what it looked like. They wanted the story behind the product. That connection between memory and meaning is what made retros special.

But here’s where it started to break...

Around 2011-2012, Jordan Brand realized they were leaving money on the table. Why retro the Chicago 1 once every five years when you could do it every two? Why make retros limited when you could make them widely available and sell five times as many pairs?

After building even more hype around retro product with the Jordan Premio Bin 23 releases (which is apparently returning in 2026?), which featured impressively high-quality materials, beautiful unboxing presentation with dust covers and shoe trees, the demand for retros was at an all-time high.

The “Remastered” program launched in 2015, promising better quality materials and construction on retros to justify the price increase from $160 to $190. The pitch was... we’re going back to OG specs, using premium materials, making these as close to the originals as possible.

Except they weren’t. Anyone who handled both versions could tell you... the leather was stiffer, the shape was off, the quality control was inconsistent. But that didn’t matter, because the story of better quality was enough. People wanted to believe they were getting something closer to the original.

And Jordan Brand learned a dangerous lesson... you don’t actually have to deliver on the promise of nostalgia. You just have to invoke it.

By 2016-2017, we were fully in the oversaturation era. The same colorways releasing what seemed like multiple times a year. Limited edition releases becoming general releases six months later. Retros of retros of retros.

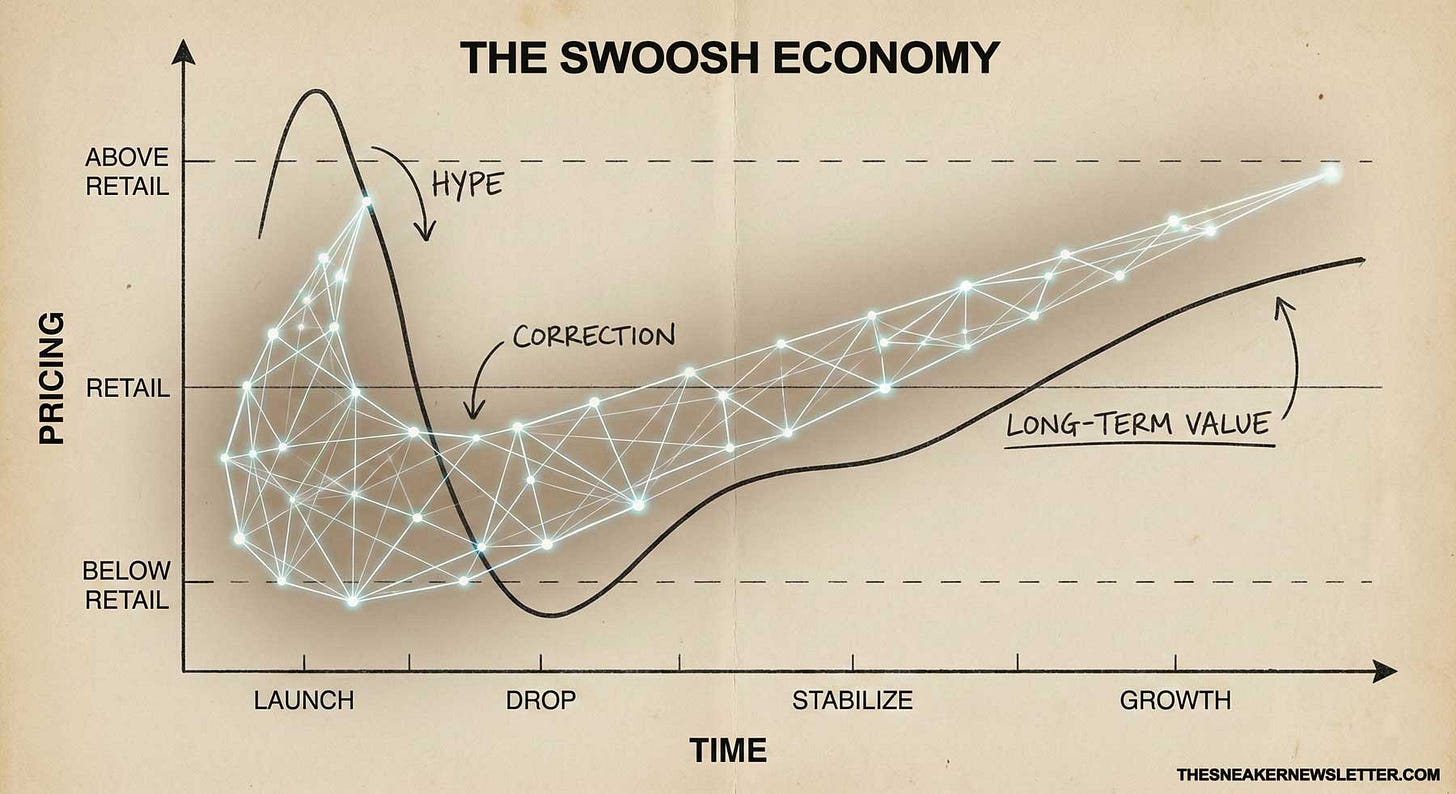

When I was at StockX starting in 2016, I watched this play out in real-time through the data. We could track exactly when a shoe lost its hype. Here’s what the pattern looked like...

First retro release: Resale prices 2-3x retail. Instant sellout. High demand.

Second retro release (2-3 years later): Resale prices 1.5-2x retail. Still strong demand, but less urgency.

Third retro release (another 2-3 years): Resale prices barely above retail. Takes weeks to sell out. Market saturation visible.

Fourth retro release: Sitting on shelves. Going to outlets. Resale below retail in some sizes.

The original colorways of the Air Jordan 1 followed this trajectory. The 2013 releases? Resale averaged $400-500. The 2015 releases? $300-400. The 2022 release? Available at retail for weeks before finally selling through. The Reimagined 2025 Black Toe is available on StockX for about a hundred bucks right now.

Same shoe. Different market conditions. Nostalgia exhaustion.

What drives me crazy about this whole cycle...

The brands saw the data. They knew what was happening. And they kept doing it anyway, because the short-term revenue justified the long-term brand damage.

Every CFO presentation showed retros as the reliable revenue stream. Low R&D costs... you’re not designing anything new. Proven demand... people already know they like the shoe. Predictable manufacturing... you’ve made this exact product before.

It’s the perfect product line... until suddenly it isn’t.

And we’re seeing that shift happen right now. Nike’s missed revenue targets in 2024 weren’t because people stopped liking Jordans. They stopped because people got tired of buying the same shoes over and over again.

The nostalgia well isn’t infinite. And Nike just learned that the hard way.

The Data Showing Nostalgia Fatigue

Let me show you exactly what nostalgia fatigue looks like when you have access to real market data.

Data has always been a part of sneaker culture, but StockX shifted the way everyone started to think about it. Suddenly how the secondary market impacted retail sales was information that every brand wanted. It also expanded my casual interest in relevant data for ocassional storytelling opportunities into thinking about how to find typically unseen data points that could be the cornerstone for content.

And the patterns started changing in ways that should have terrified every brand relying on retros.

Here’s a specific example...

The Air Jordan 4 “Bred” is one of the most iconic colorways in sneaker history. Black and red. Worn by MJ in 1989. Legendary status. It’s retro’d in 1999, 2008, 2012, and 2019.

1999 retro: Instant sellout. Resale prices stayed strong for years. Cultural moment.

2008 retro: Still a big deal. Part of the Countdown Pack releases. People wanted it.

2012 retro: Lots of hype, massive production run. Retail $160. Resale settled around $220-280. Still profitable, but the premium was shrinking.

2019 retro: Retail $200. Resale initially jumped to $300-400... then crashed within six months to $220-250. You could find them for barely above retail.

2024 Reimagined: The use of leather offered a temporary Band-aid. The shoe sold well initially. But now it’s sitting at about the same as the previous retro.

Same exact shoe. Same cultural significance. But the market had fundamentally changed.

What happened between 2012 and 2019? Simple... Jordan Brand had retro’d so many shoes so frequently that even legendary colorways lost their scarcity premium.

When I was at Stadium Goods from 2022-2024, we saw this play out across the entire wall of inventory. Shoes that would have been instant sells five years earlier were now sitting for months. And it wasn’t because people stopped caring about sneakers... it was because they’d already bought these shoes. Twice. Sometimes three times. The die-hard collectors even more times.

The consignment model gives you a brutally honest view of what people actually value. Someone brings in a DS pair of Jordan 1 Chicago from 2022, thinking they’re sitting on gold. We pull up recent sales... pairs are moving at $220-240 for a shoe that retailed at $180. That’s not an investment, that’s barely covering tax and shipping.

Compare that to 2015, when the same colorway was commanding $400-500 on the secondary market. The shoe didn’t get worse. The market got tired.

This is where the data gets really interesting...