StockX Proves Sneaker Culture Is Dead. And Thriving. Both.

How the same 2025 trends data supports completely opposite narratives... and why that's actually the story.

I’ve been in the sneaker business full-time for 20 years... from building Eastbay’s first blog to Complex Sneakers to being employee #9 at StockX to Stadium Goods. Nearly 20 years of watching this industry evolve, fragment, and rebuild itself. I host the Sneaker History podcast (500K+ downloads) and write this newsletter because I believe the stories behind what we wear matter more than the hype cycles.

If you work in sneakers, footwear, content, or marketing, this newsletter is easily expensed as industry research. And if you subscribe before January 1st at the Founding Member rate of $7/month, you lock in that price forever. After New Year’s, it goes to $10/month for everyone new. That’s $36/year in savings, plus you get three exclusive posts every week that don’t show up anywhere else.

Now let’s talk about data.

StockX released their annual trends report this week, and look... I spent enough time in that building to know how this data gets pulled together. These aren’t vibes or editorial picks. This is what people are actually searching for, actually buying, actually willing to pay resale prices for in 2025. Yes, it’s the secondary market, but it does piece together an interesting narrative about the current state of sneakers.

But what story does this data tell? It depends entirely on who’s reading it.

Admittedly, I’m not a data person. Or maybe I should say, I wasn’t. But ever since my time at StockX, data people are my best friends. We learned a lot in the earlier days at StockX, and for me personally, connecting data points to the stories I write has become a practice I can’t live without. That said, not everyone sees through the data to find the real stories. Hopefully, with newsletters like today’s, I can help translate some of the trends that would otherwise be overlooked.

Two Headlines From The Same Data

Here’s the thing about the StockX 2025 report... you can write two completely different stories from it. Both would be true. Both would be supported by the numbers. And both would tell you something essential about where sneaker culture is right now.

Headline #1: “Sneaker Culture Is Dead”

The Kobe 6 Protro is the #1 performance basketball shoe, with sales up 100%. Great. Except Kobe’s been gone since 2020, and Nike only brought these back because nostalgia sells better than innovation. The Curry line is nowhere. Under Armour just announced they’re splitting with him after 13 years of failure.

ASICS is having a moment? The Gel-1130 is the best-selling sneaker on StockX? That’s not innovation... that’s the same Y2K nostalgia wave that’s kept fashion on life support since… 2019. We’re not creating new classics. We’re just re-buying the old ones with better marketing.

Brooks running shoes are up 1,508%. Mizuno up 148%. Saucony up 38%. You know what that tells me? People stopped caring about sneakers as culture and started caring about sneakers as... shoes. Functional products. The thing we lost somewhere between the first Jordan release and the NFT drop that never delivered.

The Jordan 4 is up 204% but that’s a 40-year-old silhouette. Where’s the new stuff? Where’s the innovation?

Sneaker culture didn’t die in a collapse. It died by becoming exactly what we said it wouldn’t... a bunch of people buying the same retro shoes their parents wore, pretending it’s still rebellious.

Headline #2: “Sneaker Culture Is Thriving”

Now let’s flip it.

ASICS up 45% year-over-year. Brooks up 1,508%. Mizuno up 148%. You know what that tells me? Sneaker culture is healthy enough that it’s not just about Nike and adidas anymore. People are discovering brands with actual heritage, actual craft, and actual stories beyond hype drops and manufactured scarcity.

The adidas Tokyo is up 2,820%. The Bottega Veneta Orbit is up 1,569%. Those aren’t mass-market shoes. Those are people making intentional choices about what they put on their feet.

Kobe 6 sales up 100%? That’s not just nostalgia. That’s a generation of young hoopers who never saw Kobe play, discovering what made him legendary. That’s culture passing down. Same with the Jordan 4... yeah, it’s 40 years old, but it’s 16-year-olds who weren’t alive when Spike and Mars did those commercials, learning why this shoe mattered.

The Samba isn’t a sign of creative death... it’s proof that good design endures. Over 700 colorways means brands are giving people options, letting them find their version of a classic.

And yeah, maybe the resale market is cooling off from the 2020-2021 chaos. But that’s healthy. That’s sustainable. That’s sneaker culture growing up and realizing that not everything needs to be flipped for profit to have value.

Sneaker culture isn’t dying. It’s diversifying. It’s maturing. It’s becoming something bigger than just Nike’s quarterly earnings and whatever celebrity wore what shoe to what event.

So Which Story Is True?

Both.

That’s the thing about data... it reflects reality, but reality is complicated. Sneaker culture in 2025 is simultaneously stagnant and evolving, nostalgic and forward-looking, exclusive and accessible, dying and thriving.

The real story isn’t “sneaker culture is dead” or “sneaker culture is thriving.” The real story is that sneaker culture has fractured into so many different subcultures that the term “sneaker culture” might not even mean anything anymore.

There’s performance culture... people buying Kobes and Currys because they actually hoop. There’s lifestyle culture... people buying Sambas and ASICS because they look good with jeans. There’s collector culture... people buying Jordan 4s because they want the history, the story, the connection to something bigger.

There’s running culture, where Brooks and Mizuno matter more than any Jordan release. There’s fashion culture, where Bottega Veneta and Onitsuka Tiger are status symbols that most sneakerheads have never heard of. There’s hype culture, still chasing whatever drops next.

It should be noted that Brooks dropping a collab with Staple in the famous “Pigeon” colorway skews these numbers. Brooks was almost non-existent on the secondary market last year. While this feels like an anomaly of sorts, it’s also an example of what kind of energy a good collaboration can still do for a brand.

And here’s the thing... they’re all right. They’re all sneaker culture. They’re all valid.

The mistake is thinking sneaker culture is one thing. It never was. We just pretended it was because Nike and Foot Locker and Complex (where I used to work) all benefited from that narrative… because each of those companies wants one thing… more sneaker enthusiasts.

What The Data Actually Tells Us

Performance basketball is consolidating around legacy. The Kobe 6 Protro dominates because Kobe transcends basketball. The Ja 3 is #1 for new models because Ja is the most exciting young player Nike has. But notice what’s missing... no Curry. No signature shoes from Detroit. No breakthrough models from unknown players.

Market exposure still matters more than talent. It’s been true since Grant Hill’s Filas in 1995, and it’s still true now.

Silhouettes are having a moment because people are tired of the algorithm. The adidas Tokyo up 2,820%. The Nike Total 90 up 859%. The Saucony Omni 9 up 850%. These aren’t shoes that Instagram is pushing at you repeatedly. These are shoes you find because you went looking.

That’s the opposite of hype culture. That’s people opting out of the feed and finding their own path.

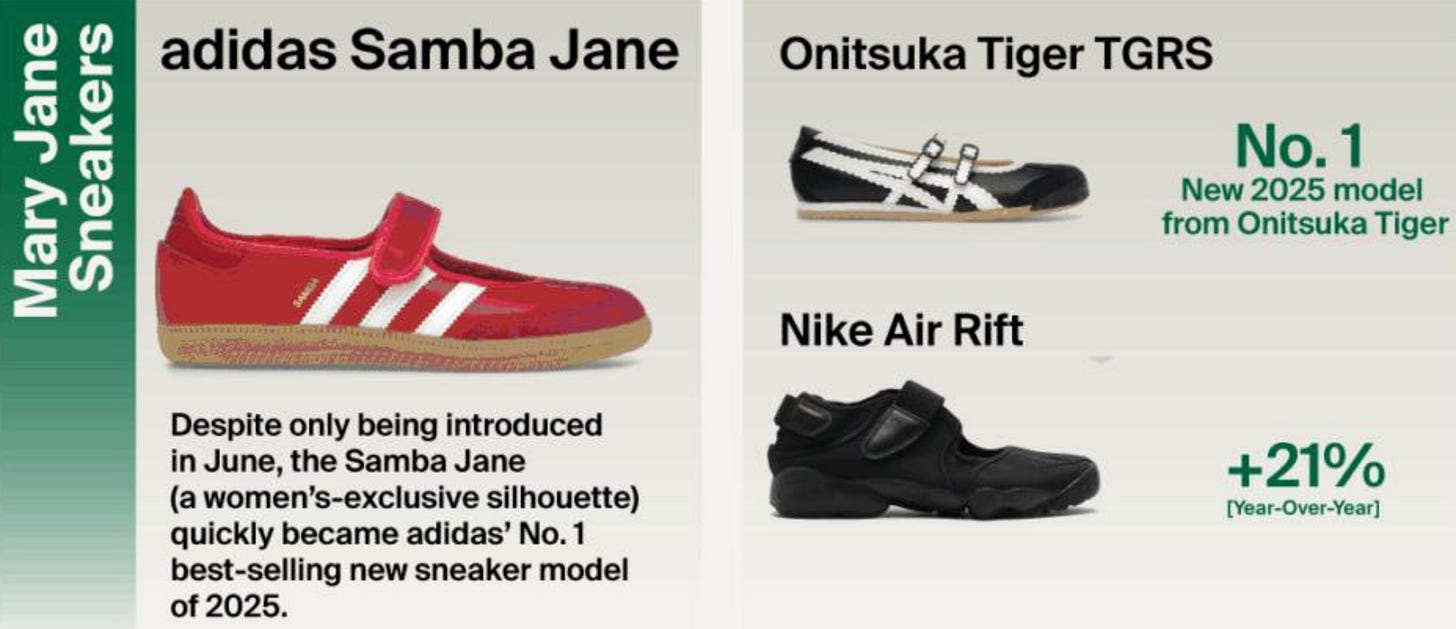

Women’s sneakers are finally getting real attention. The adidas Samba Jane became adidas’ #1 best-selling new sneaker model of 2025 despite only launching in June. The Onitsuka Tiger TGRS is the #1 new model from Onitsuka Tiger. These aren’t just smaller versions of men’s shoes. These are silhouettes designed specifically for women, and they’re driving culture. Not to mention A’ja Wilson’s signature basketball shoe!

That’s progress. Real progress.

Lifestyle runners are eating everyone’s lunch. ASICS is up 45% year-over-year. The Gel-1130 is the #1 best-selling sneaker on StockX so far this year. Not a Jordan. Not a Yeezy. A $110 lifestyle runner that most people couldn’t have named three years ago.

Brooks, Mizuno, Saucony... all surging. These aren’t hype brands. These are brands that make good shoes and let the product speak. And people are responding because they’re tired of buying status symbols that lose their “cool” after six months.

The Mary Jane Revolution Nobody Saw Coming

Can we talk about the adidas Samba Jane for a second? Because this might be the most important shoe in the whole report.

Despite only being introduced in June, the Samba Jane quickly became adidas’ #1 best-selling new sneaker model of 2025. Not a men’s shoe that sold well. A women’s-exclusive silhouette that drove culture.

For decades, women’s sneakers were afterthoughts. Pink versions of men’s shoes. “For her” collections that were just men’s designs with feminine colorways.

The Samba Jane is different. It’s a Mary Jane sneaker... a silhouette that’s distinctly feminine but functional, stylish but comfortable, fashion-forward but rooted in sneaker heritage.

And it’s outselling almost everything else adidas released this year.

That’s not a trend. That’s a shift. That’s the market telling brands that women don’t want men’s shoes in smaller sizes... they want shoes designed for them.

The Onitsuka Tiger TGRS tells the same story. This is what real progress looks like in sneaker culture. Not just representation in marketing campaigns, but women’s-exclusive silhouettes that matter enough to drive sales and shape trends.

What Nike’s Crisis Means For Everyone

Nike is in trouble. Not “going out of business” trouble, but “we have no idea what we’re doing anymore” trouble.

They brought back Elliott Hill... a 32-year Nike veteran who retired in 2020 and came back in October 2024 to clean up John Donahoe’s mess. Stock jumped 8% on the announcement because everyone knew Donahoe (the tech guy with no sneaker background) had broken something fundamental.

Revenue down. Market share down. Cultural relevance down. Meanwhile, On Running and Hoka are stealing their customers, New Balance is cool again, and ASICS is having a moment Nike should have seen coming.

Nike’s response? Bring back retros. The Jordan 4 is up 204%. Great. That’s a 40-year-old shoe. Where’s the new stuff?

The Total 90 trademark disaster is the perfect metaphor. Nike let one of their most iconic football trademarks lapse in 2019 because they were too busy restructuring and laying people off to maintain institutional knowledge. Now they’re fighting a legal battle to get it back right before the 2026 World Cup.

That’s not a company that has its priorities straight. Hopefully, it’s just a carryover from the misguided Donahoe days.

Because when Nike stumbles, the entire sneaker industry feels it. They’re still the biggest player, still the cultural bellwether, still the brand everyone else is chasing or running from. Still the brand you never bet against.

Or maybe this time, Nike’s crisis is everyone else’s opportunity.

So, Where Does That Leave Us?

The StockX 2025 trends report tells us that sneaker culture is complicated, fractured, evolving, and impossible to summarize in a single narrative.

Basketball sneakers are stagnant but still selling. Retros are dominating, but new classics are being made. Nike is struggling, but still the biggest player. ASICS is surging, but will they sustain it? Women’s sneakers are finally getting real attention, but still have a long way to go.

Both the “sneaker culture is dead” and “sneaker culture is thriving” narratives are true because sneaker culture isn’t one thing anymore. It’s a bunch of overlapping subcultures, each with their own values, aesthetics, and economics.

The people buying Kobe 6s aren’t the same people buying Samba Janes, aren’t the same people buying ASICS Gel-1130s, aren’t the same people buying Bottega Veneta Orbits. They’re all participating in sneaker culture, but they’re not participating in the same sneaker culture.

And that’s fine. That’s healthy. That’s what happens when something grows beyond its origins.

The mistake is thinking there’s one “real” sneaker culture and everything else is fake, or trend-chasing, or not serious enough. That’s gatekeeping. That’s the same mentality that kept sneaker culture small and exclusive for decades.

Sneaker culture in 2025 is big enough for all of it. Performance and lifestyle. Retro and innovation. Nike and ASICS. Hype and accessibility. Collectors and casual wearers.

The data proves it. You just have to decide which story you want to tell.

This is the kind of analysis you get three times a week as a paid subscriber. Industry insider perspective you can’t get anywhere else. Real talk from someone who helped build the platforms, worked at the companies, and has the scars to prove it.

Founding Member pricing ends January 1st, 2026. $7/month locks you in forever. After that, it’s $10/month for everyone new. That’s not just a newsletter subscription... that’s 20 years of industry knowledge, delivered to your inbox every Tuesday, Thursday, Friday, and Sunday.

If you work in this industry, this is the easiest expense report you’ll file all year.

I don’t really involve myself in sneaker culture. I stay in my own lane and collect Air Max 90s, nothing else. What I’ve noticed this year, though, is a shift toward nostalgia over innovation. It’s the 35th anniversary of the AM90, and instead of celebrating it with something fresh or meaningful, several big collaborations have leaned on recycled ideas. The Size? and Patta releases are the clearest examples. They feel more like rewinds than progress.

Great read! Helpful seeing the proof in the pudding with numbers to back it up. I think the reality is sneaker culture will never really be dead, they’ll always be a sub group that’s trendy or thriving. What’s missing is the innovation which I believe you touched on. What made collabs so exciting before was we were seeing designs we weren’t seeing before, Nike did this especially well with their SB dunks. Every now again there’s one that gets me excited, but they’re not having consistent bangers